If you’re like me, the last time you took an accounting class was in college. So, what do you do when you’re starting a small business and can’t quite justify an accountant? You find the best small business accounting software to meet your budget and needs.

If you’re just starting this search, it won’t take long for you to discover the accounting software landscape is a packed one. It can be difficult to know where to start, which solutions offer the features you need, and whether they’re better for enterprise or startup size. So, I’ve put together a list of the best accounting software just for small businesses.

Browse the list below and find a solution that will help your business grow -- and keep you from feeling like you’re failing your accounting midterm ... again.

What Accounting and Bookkeeping Software Should You Use?

It's great to have a list of software, but how do you identify which is the right one for your business? Here are a few things to keep in mind when you're searching for accounting or bookkeeping software.

Identify your needs

Do you need a platform that allows you to track inventory or are receipt-tracking and sales tax more direct concerns? Make a list of your accounting needs and prioritize them from least to most important.

Before you start researching solutions, agree upon a goal number of needs your chosen software will meet. You can be flexible here, but it's easy to get distracted by the bells and whistles of a product that solves for 18 needs you don't have.

Be honest about your budget

Again, before you embark on the research phase of the process, identify how much you can afford to spend on accounting or bookkeeping software. Once you know how much money you have budgeted, try not to spend too much time evaluating software that's outside the realm of possibility.

Budgets often have some wiggle room but make it a rule that if a solution is more than 25% over your set budget, you'll walk away.

Research for features that meet your needs

It's easy to get starry-eyed about features. But if you find yourself considering software that specializes in providing accounting services for global teams -- and you only conduct business in the US -- you might find yourself paying for a lot you just don't need.

Don't get distracted. Return to your list of prioritized needs and evaluate only the software that meets the majority of those needs.

Ask the right questions

If you're choosing software that requires a sales process, it's important you ask the right questions. Here are a few to ask:

- "How secure is your API?"

- "How do you back up system data?"

- "What other costs or fees should I expect?"

- "Tell me about customer support. What are their hours and how quickly should I expect to get a response if I submit an issue or a question?"

- "Can you tell me about a client you've worked with that's similar to my business? What pain points have they experienced with your software?"

Pick a solution that will grow with you

"I can't wait to buy more software ..." said no one ever. Of course, if your solution isn't working for your company, you should find a new one as soon as you can. But you don't want to have to switch software in six months because you've already outgrown it.

Be realistic about how quickly your business is growing and ask the sales rep you're working with how well their product grows with clients as their businesses scale.

Best Accounting Software for Small Business

1. Intuit QuickBooks Online

Image source: QuickBooks

- Best for: Receipt capture, 24/7 chat support, and integrations with PayPal, Shopify, and Square make this a crowdpleasing small business software. All plans allow you to track income and expenses, send invoices and receive payments, run reports, send estimates, track sales and taxes, and capture and organize receipts. More advanced plans allow you to track inventory, manage 1099 contractors, track time, and even run full service payroll.

- Pricing: Simple Start, $7/month for one user; Essentials, $17/month for up to three users; Plus, $30/month for five+ users

- App: iOS | Android

2. FreshBooks

Image source: FreshBooks

- Best for: If you send out recurring invoices, need time tracking capability, or run a subscription model business, FreshBooks could be ideal for you. You can even see the exact location a customer opened your invoice -- to avoid those pesky “I never got it” excuses. They integrate with many business applications and provide you with a single dashboard to manage your finances and accounting. Regular secure backups are included, and a mobile app allows you to keep track of your business at all times.

- Pricing: Lite, $15/month for five clients; Plus, $25/month for 50 clients; Premium, $50/month for 500 clients; Yearly plans available for 10% off

- App: iOS | Android

3. Wave

Image source: Wave

- Best for: If you’re operating as a freelancer, or have just a few employees, Wave could be for you. Most of its services are free, including invoice- and transaction-management. And all of your information syncs with Wave’s software, so your bookkeeping is always up to date. However, if you’re looking for built-in time tracking, inventory tracking, or project management, you’ll likely need a different software.

- Pricing: Accounting, free; Invoicing, free; Receipt scanning, free; Online payments, 2.9% + $.30/transaction; Payroll, $35/month base fee in tax service states and $20/month base fee in self-service states

- App: iOS | Android

4. Sage 50cloud

Image source: Sage 50cloud

- Best for: Sage works well for small- to medium-sized businesses. You’ll spend less time on administrative tasks, since Sage sends invoices, tracks payments and expenses, and calculates what you owe come tax season. Time tracking and collaboration tools are two things you won’t get with Sage, and payroll is a separate product.

- Pricing: Pro Accounting, $46.83/month for one user; Premium Accounting, $72.41/month for one user; Quantum Accounting, $182.91/month for three users; Yearly plans available

- App: iOS | Android

5. Xero

Image source: Xero

Image source: Xero

- Best for: Do you conduct most of your business on the go? Xero allows you to send custom invoices, track inventory, and create purchase orders to attach to bills -- all from your phone or tablet. Get financial performance reports sent straight to you, and connect your bank account for a seamless experience. If you need payroll services, you’ll have to use them through Xero’s partnership with Gusto. And if you value live support, you should probably look for another provider.

- Pricing: Starter, $9/month; Standard, $30/month; Premium, $70/month

- App: iOS | Android

6. Zoho Books

Image source: Zoho

- Best for: Want accounting software known for its ease of use? Give Zoho a look. Perfect for helping your small business manage cash flow and finances, Zoho also offers excellent support, the ability to accept payments online, balance sheet creation, and an easy-to-read dashboard users love.

- Pricing: Basic, $9/month per organization; Standard, $19/month per organization; Professional, $29/month per organization; Yearly plans available at a discounted price

- App: iOS | Android

7. GoDaddy Bookkeeping

Image source: GoDaddy

- Best for: This low-cost option integrates with and imports data from Amazon, eBay, Etsy, and your bank accounts. It puts that data to use creating invoices and calculating quarterly tax estimates. If you sell over one of the sites listed above, GoDaddy could be a good option for you. However, if you’re looking for a solution offering project management, extensive reporting, and international billing capabilities, GoDaddy won’t meet your needs.

- Pricing: Get Paid, $4.99/month; Essentials, $9.99/month; Premium, $14.99/month

- App: iOS | Android

8. Kashoo

Image source: Kashoo

- Best for: Perfect for small businesses searching for a truly simple solution, Kashoo tracks expenses, enables customized invoices, offers insightful reporting you can share with your accountant, integrates with Stripe and BluePay to accept credit card payments, and provides real-time bank feeds.

- Pricing: Annual, $16.65/month or $199.95/year; Pay As You Go, $29.95/month

- App: iOS

9. AccountEdge Pro

Image source: AccountEdge

- Best for: If mobile isn’t a deal breaker for you, AccountEdge could be just what you need. It provides double-entry accounting tools -- from time billing and reporting to inventory -- that are customizable and optimized for desktop users. Like the software but really need a mobile option? A cloud-collaboration option is available for purchase.

- Pricing: AccountEdge Pro, $399 one-time fee; AccountEdge Basic, $149 one-time fee

10. OneUp

Image source: OneUp

- Best for: Another double-entry accounting solution, this software is especially advantageous if you’re focused on inventory management and pricing. It syncs with your bank, categorizes bank entries, and validates suggested entries so your books are done quickly and accurately.

- Pricing: Self, $9/month; Pro, $19/month for two users; Plus, $29/month for three users; Team, $69/month for seven users; Unlimited, $169/month for unlimited users

- App: iOS | Android

11. Tipalti

Image source: Tipalti

- Best for: If you’re a deadline-driven business, Tipalti can help you meet them every time. Late payments, non-compliance, and administrative overload are all issues they aim to correct. They can streamline international payment processing in around 190 countries, automate your payment operations, and even make sure you’re tax compliant.

- Pricing: Available upon request

12. OnPay

Image source: OnPay

- Best for: If you’re a small- to medium-sized business that needs help streamlining payroll, automating tax filings, and entering payment data, you might consider OnPay. The solution can also manage benefits including compensation insurance, health insurance, and 401(k). You’ll also receive unlimited payroll runs for W-2 and 1099 workers. And, OnPay can estimate your payroll taxes, manage tax form filings, and even pay your taxes. A bonus here? They’ll also take responsibility for any tax filing errors committed while using the product.

- Pricing: $36/month base fee + $4/month per person

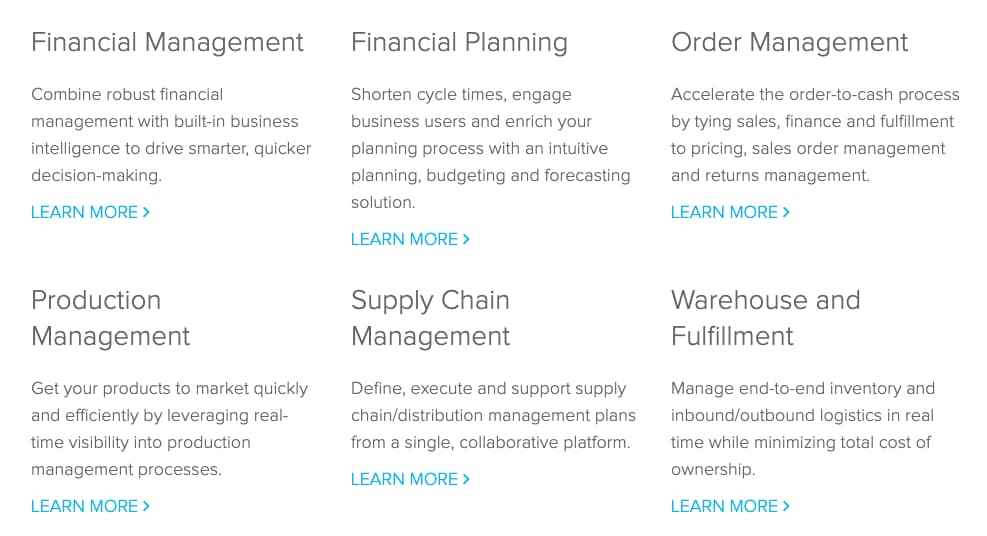

13. NetSuite ERP

Image source: NetSuite

- Best for: NetSuite prides itself on growing with businesses, "from pre-revenue through IPO and beyond." Their Enterprise Resource Planning (ERP) product helps businesses manage inventory, order management, accounting, human resources, and beyond -- integrating these functions into one system that's streamlined. If you anticipate rapid growth, you might want to consider NetSuite ERP.

- Pricing: Available upon request

14. FreeAgent

Image source: FreeAgent

- Best for: If you create a lot of estimates and invoices, want to monitor your cash flow, keep track of receipts, and track your time -- look no further than FreeAgent. You can also connect FreeAgent to your bank account and view income performance and profitability. Sign up for a 30-day free trial and rest easy that you have a transparent view into every financial aspect of your business.

- Pricing: $12/month for 6 months, then $24/month

- App: iOS | Android

15. Accounting Seed

Image source: Accounting Seed

- Best for: Accounting Seed offers subscription or recurring billing options, has a secure and reliable API, and works with your company to link critical business applications and bank accounts for real visibility into the financial state of your business. It's also a cloud-based platform, meaning you can log in anytime, anywhere. And it automates many of the menial tasks that eat up your day.

- Pricing: Base price, $250/month + $55/user/month

Leaving your accounting to chance -- or an intern -- is never something you want to do. Invest in the right software early on, and know when it’s time to upgrade, outsource, or find a solution that better fits your company’s needs as you grow. Happy number crunching!